income tax rates 2022 australia

There are no changes to most withholding schedules and tax tables for the 202223 income year. All of your ordinary income and disposals from cryptocurrency held for less than 12 months will be taxed according to these tax rates.

Budget Overview 2022 23 Budget

A patent box regime for medical and.

. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above 539900 for single filers and above 647850 for married couples filing jointly. Here are Australias tax rates for the 2021-2022 financial year. 39000 37c for each 1 over 120000.

Tax rates and codes. 2022 Income Tax Rates Australia. From 1 July 2022Check the fuel tax credit rates from 1 July 2022 to 28 September 2022.

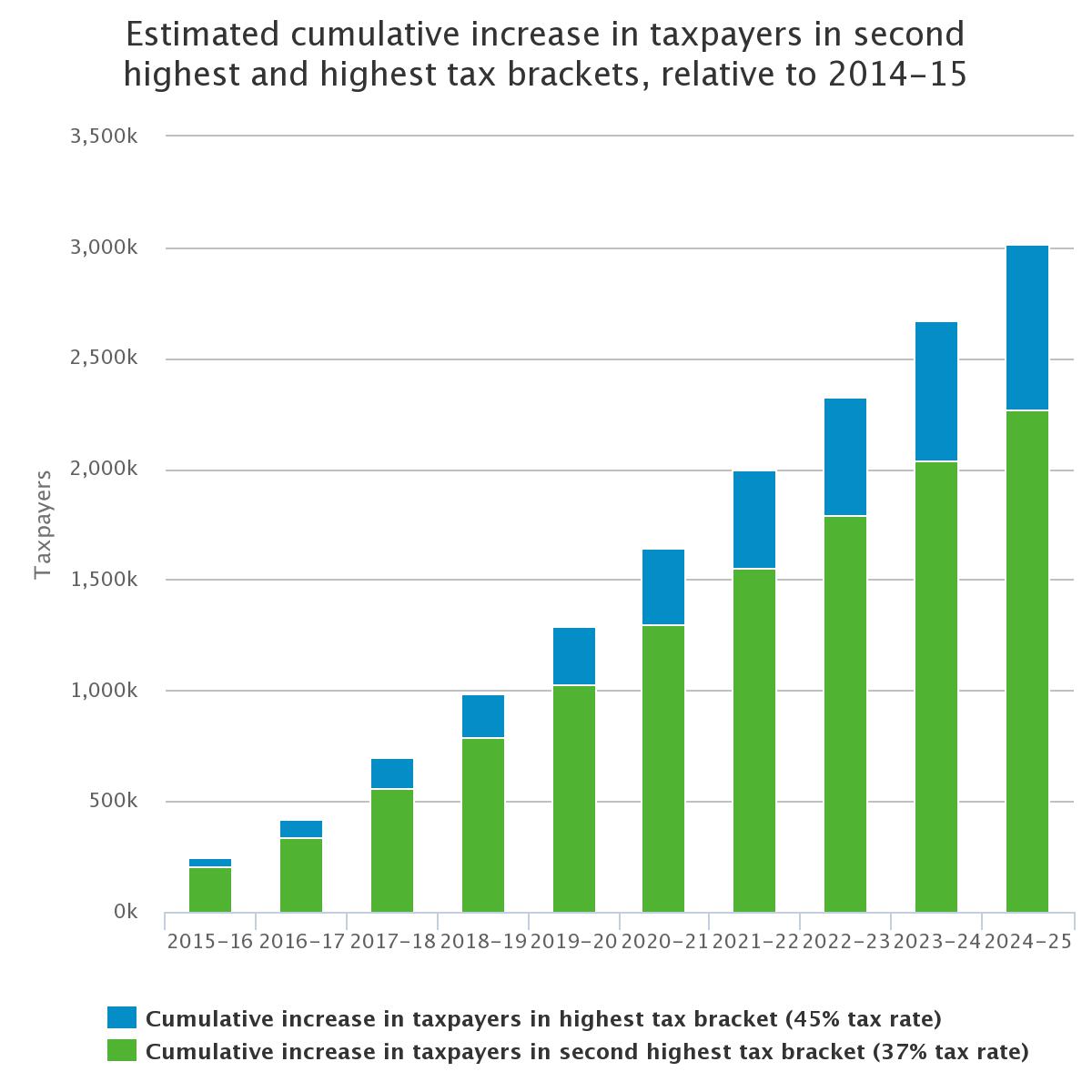

Austria Residents Income Tax Tables in 2022. 3 Employer lump sum payments 2022. These rates and thresholds are planned to continue until 30 June 2024 after which the next legislated phase of the tax cuts will take effect from 1 July 2024 whereby the 325 and 37 marginal tax rates will be removed resulting in.

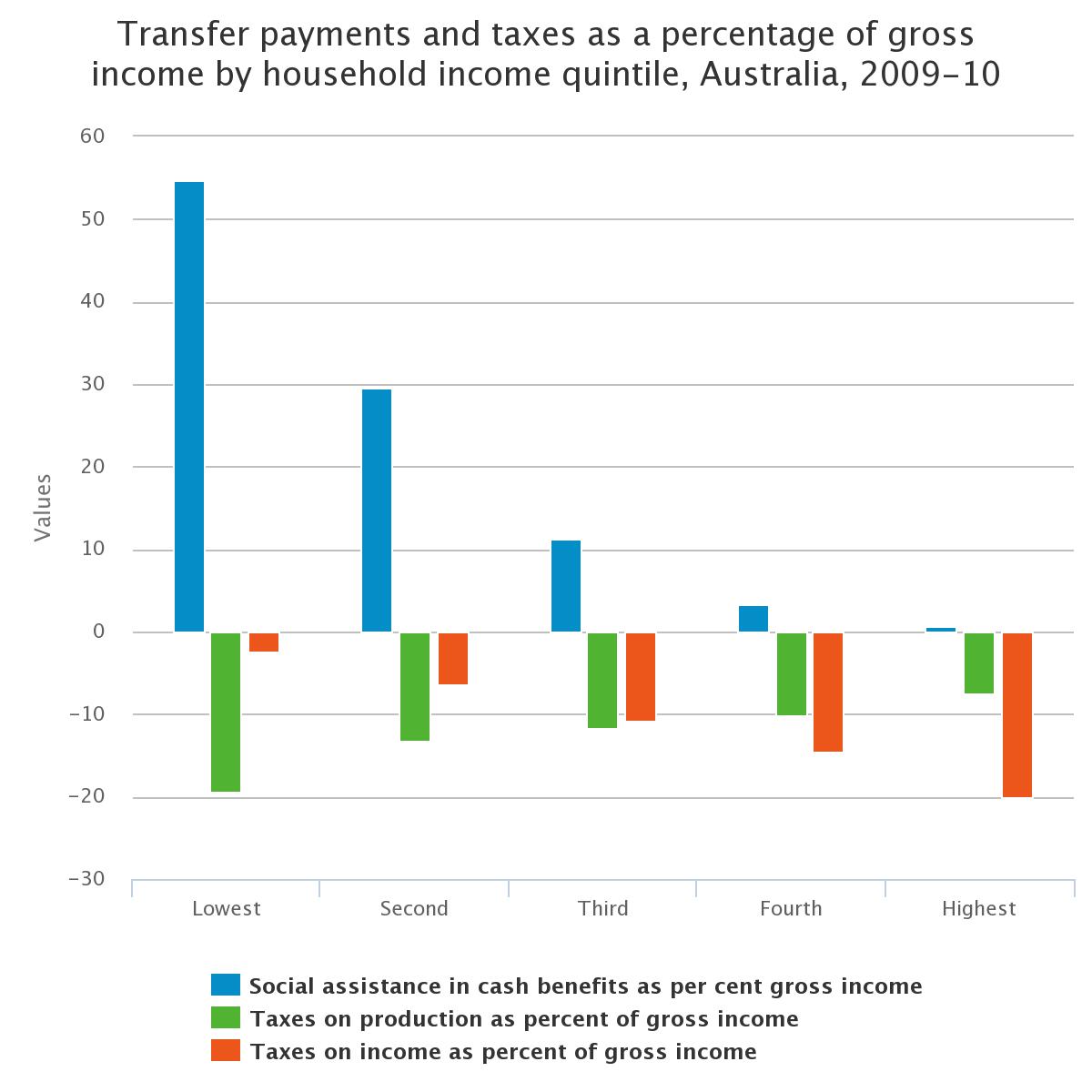

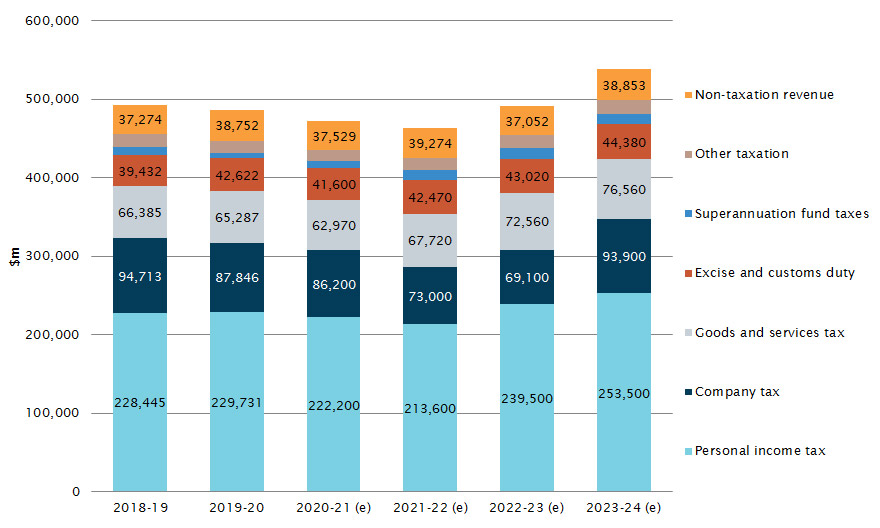

Company taxThe company tax rates in Australia from 200102 to 202122. Australia has a bracketed income tax system with five income tax brackets ranging from a low of 000 for those earning under 6000 to a high of 4500. That means youll only pay taxes on.

Important information July 2022 updates. 1 Salary or wages 2022. There are seven federal income tax rates in 2022.

Australia Personal Income Tax Tables for 2022. In the long-term the Australia Personal Income Tax Rate is projected to trend around 4500 percent in 2022 according to our econometric models. 2 Allowances earnings tips directors fees etc 2022.

You can find our most popular tax rates and codes listed here or refine your search options below. Base rate entity company tax rates The company tax rate for base rate entities has fallen from 275 to 26 in 20202021 financial year and is now down to 25 for 20212022 and later income years. Reflected in the above table are tax rate changes from the 2018 Budget for the 2 years from 1.

Two further incentive regimes are proposed to start as from 1 July 2022. Taxable Income Tax Rate. Individual income tax for prior yearsThe amount of income tax and the tax rate you pay depends on how much you earn.

4 Employment termination payments ETP 2022. Personal Income Tax Rate in Australia is expected to reach 4500 percent by the end of 2021 according to Trading Economics global macro models and analysts expectations. The more you earn the higher your rate of tax.

Make sure you click the apply filter or search button after entering your refinement options to find the specific tax rate and code you. 5 Australian Government allowances and payments 2022. 6 Australian Government pensions and allowances 2022.

With the annual indexing of the repayment incomes for study and training support loans the following schedule and tax tables were. To get an idea of what kind of total tax savings taxpayers on a range of different incomes could make in 202223 compared to 201819 the Australian Government has provided the following breakdown. Income earned from disposing of cryptocurrency held longer than 12 months is eligible for a 50 discount.

A base rate entity for an income year is. Income tax rate and will provide a minimum net tax benefit of 85 with a premium tier of 165 for an RD spend with an intensity exceeding 2. The following tables sets out the PIT rates that currently apply to resident and non-resident individuals for the year ending 30 June 2022.

Tax tables for previous years are also available at Tax rates and codes. Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold.

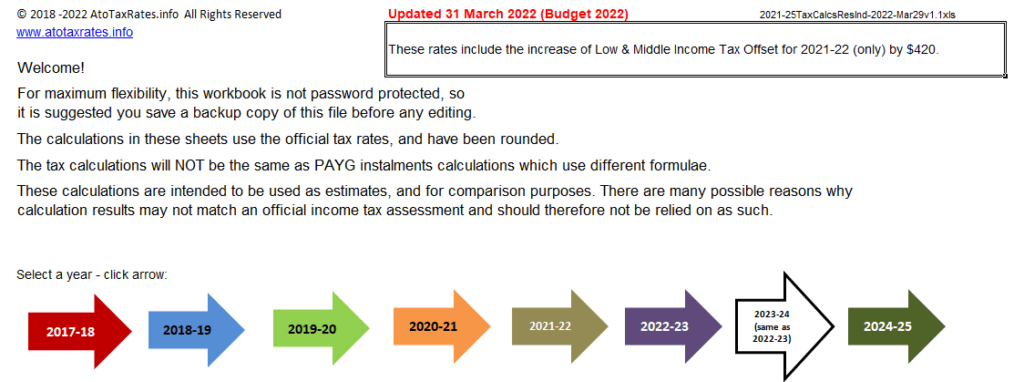

Australian Tax Calculator Excel Spreadsheet 2022 Atotaxrates Info

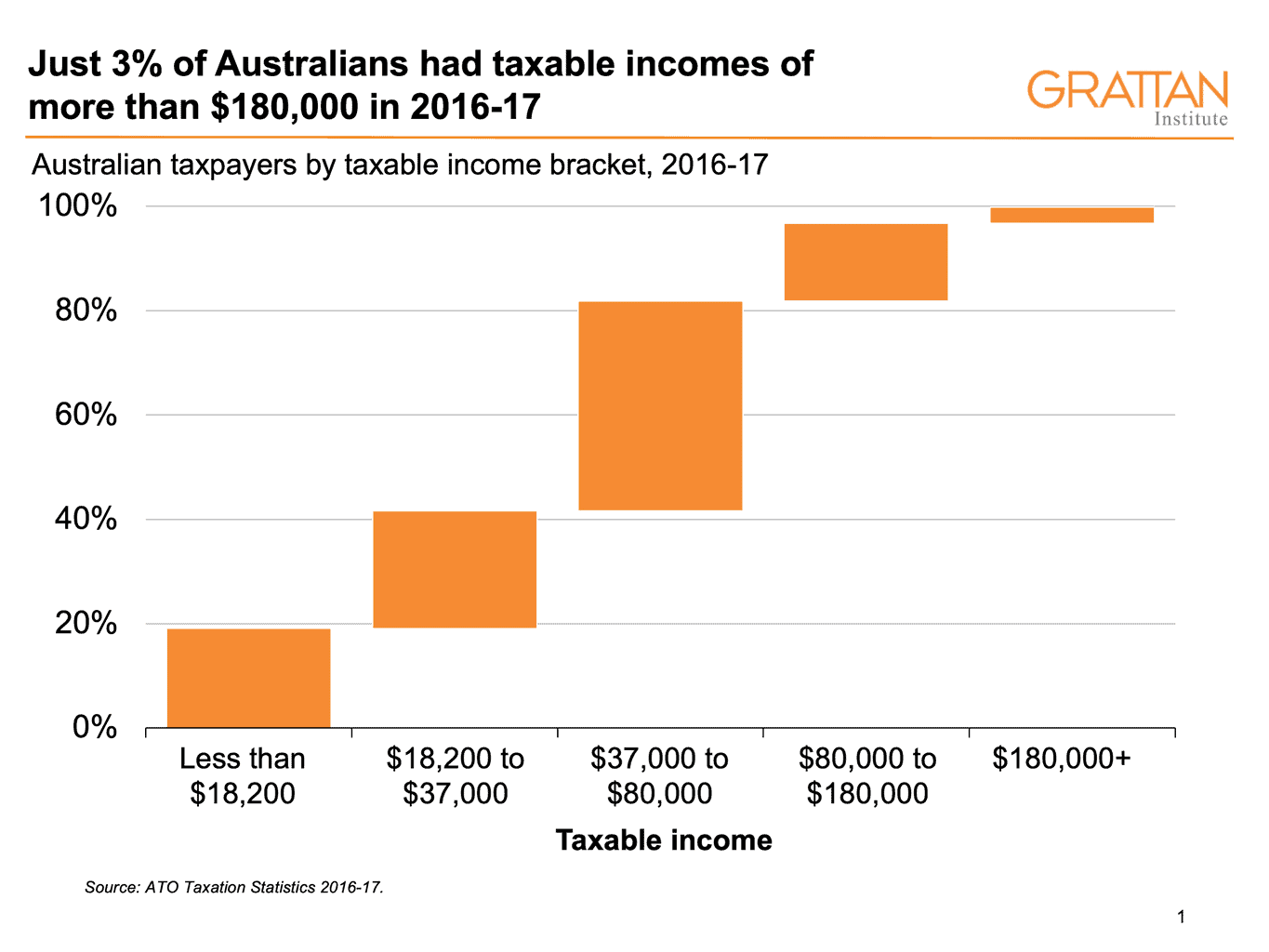

Stage 3 Tax Cuts Go To Wealthy Occupations Low Middle Income Earners Miss Out Report The Australia Institute

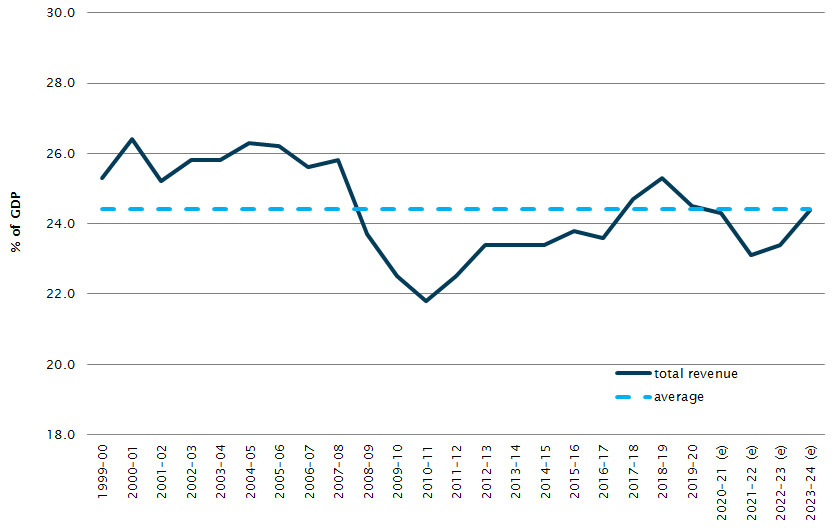

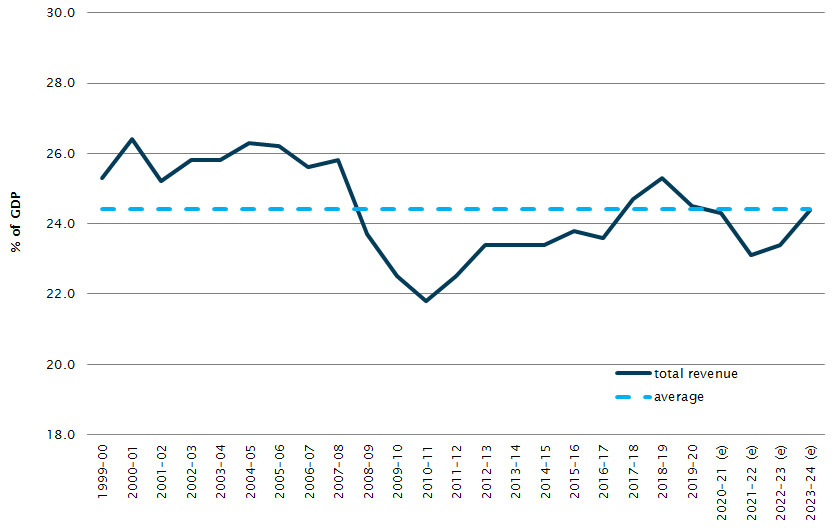

Australian Government Revenue Parliament Of Australia

1040 Income Tax Cheat Sheet For Kids

Australian Government Revenue Parliament Of Australia

How Much Does The Typical Australian Earn The Answer Might Surprise You Grattan Institute

Australian Government Revenue Parliament Of Australia

Australian Government Revenue Parliament Of Australia

Australia S Personal Tax Take Second Highest In Oecd

Australian Tax Calculator Excel Spreadsheet 2022 Atotaxrates Info

Australian Income Tax Brackets And Rates 2021 22 And 2022 23